Analysis of Latest Tungsten Market from Chinatungsten Online

On Monday, tungsten prices continued their upward trend, with the supply-driven model, constrained by objective factors and driven by subjective sentiment, persisting. This, coupled with support from long-term contract price increases by major tungsten producers, led to a predominantly bullish market sentiment.

Objectively, upstream tungsten mining is affected by multiple factors, including declining ore grades, environmental and safety inspections, crackdowns on illegal mining and smuggling, and total mining volume control targets. Raw material supply remains tight, providing strong support for tungsten prices. Subjectively, given the current complex international political and economic environment, market participants hold optimistic expectations for the long-term value of tungsten as a strategic resource and safe-haven asset, resulting in a clear reluctance among holders to sell.

It is worth noting that on the demand side, downstream enterprises have varying capabilities to absorb high costs. While essential purchases remain stable, non-essential orders have decreased significantly, leading to a cautious market sentiment and suppressing transaction volume.

As of press time,

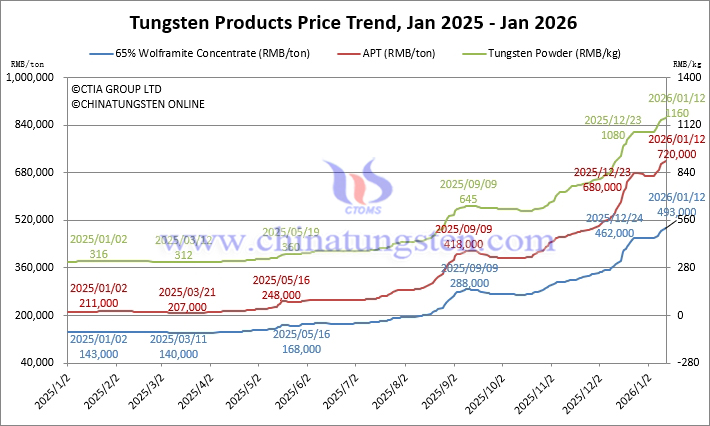

65% wolframite concentrate is priced at 493,000/ton, a 244.8% increase compared to the beginning of 2025.

65% scheelite concentrate is priced at RMB 492,000/ton, a 246.5% increase compared to the beginning of 2025.

Ammonium paratungstate (APT) is priced at RMB 720,000/ton, a 241.2% increase compared to the beginning of 2025.

European APT is priced at USD 950-987/mtu (equivalent to RMB 567,000-609,000/ton), a 193.5% increase compared to the beginning of 2025.

Tungsten powder is priced at RMB 1,160/kg, a 267.1% increase compared to the beginning of 2025.

Tungsten carbide powder is priced at RMB 1,120/kg, a 260.1% increase compared to the beginning of 2025.

Cobalt powder is priced at RMB 570/kg, an increase compared to the beginning of 2025.

70% ferrotungsten is priced at RMB 680,000/ton, a 216.3% increase compared to the beginning of 2025.

European ferrotungsten is priced at USD 133-142/kg W (equivalent to RMB 649,000-693,000/ton), a 212.5% increase compared to the beginning of 2025.

Scrap tungsten rods are priced at RMB 660/kg, a 209.1% increase compared to the beginning of 2025.

Scrap tungsten drill bits are priced at RMB 650/kg, a 193.9% increase compared to the beginning of 2025.

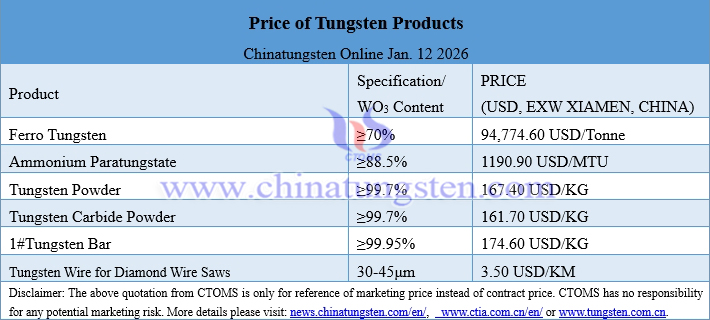

Prices of Tungsten Products on January. 12, 2026

Tungsten Price Trend from January 2025 to January 2026