Analysis of Latest Tungsten Market from Chinatungsten Online

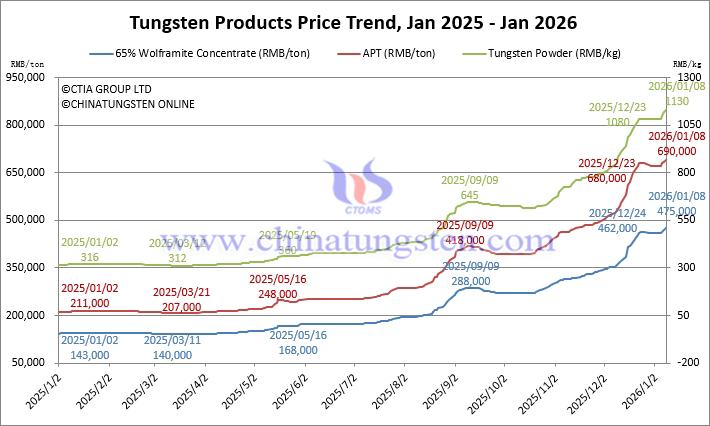

Tungsten prices have shown a steady upward trend, mainly driven by a tight supply-demand balance and rising valuations of strategic resources. However, the continued price increase has also put pressure on the supply chain. Downstream users have limited acceptance of the rising raw material costs, resulting in a cautious trading atmosphere in the tungsten market and making it difficult for transaction volume to increase significantly. The market is primarily focused on stockpiling demand before the New Year and Spring Festival holidays.

In the tungsten concentrate market, the tight supply situation has not eased significantly. Mining companies and holders are generally optimistic about the market outlook, and prices remain firm.

65% wolframite concentrate is priced at RMB 475,000/ton.

65% scheelite concentrate is priced at RMB 474,000/ton.

In the ammonium paratungstate (APT) market, prices are following the trend of tight supply and high prices upstream. The overall operating rate of smelting enterprises is still affected by maintenance cycles, and market transactions are mainly based on long-term contracts, with limited spot transactions.

Domestic APT is priced at RMB 695,000/ton.

European APT is priced at USD 900-945/mtu (equivalent to RMB 557,000-585,000/ton).

In the tungsten powder market, uncertainties surrounding raw material supply and the pace of manufacturing recovery, coupled with the complexity of the international political and economic environment, have led to a cautious wait-and-see attitude. Prices fluctuate with upstream costs, and transactions are based on immediate needs.

Tungsten powder is priced at RMB 1130/kg.

Tungsten carbide powder is priced at RMB 1090/kg.

Cobalt powder is priced at RMB 560/kg.

In the ferrotungsten market, production costs have increased significantly, leading to corresponding price increases by manufacturers. However, downstream enterprises have limited enthusiasm for concentrated stockpiling, and the market is replenishing inventory only according to essential needs.

70% ferrotungsten is priced at RMB 660,000/ton.

European ferrotungsten is priced at USD 133-142/kg W (equivalent to RMB 651,000-695,000/ton).

In the tungsten waste and scrap market, traders have differing attitudes, with some holding onto their stock in anticipation of price increases while others intend to reduce their holdings and realize profits. This has led to a widening of market price ranges, putting pressure on negotiating prices, and creating an overall cautious atmosphere.

Scrap tungsten rods are priced at RMB 660/kg.

Scrap tungsten drill bits are priced at RMB 650/kg.

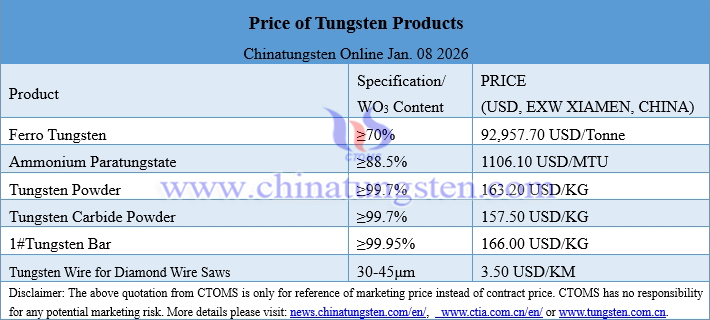

Prices of Tungsten Products on January. 8, 2026

Tungsten Price Trend from January 2025 to January 2026