Analysis of Latest Tungsten Market from Chinatungsten Online

2026 is destined to be a pivotal year for the tungsten market, fraught with uncertainty and challenges. At the start of the year, two major black swan events occurred in quick succession: first, the outbreak of the Venezuelan geopolitical crisis led to a sharp rise in global risk aversion; second, my country tightened export controls on dual-use items to Japan, prohibiting the export of all dual-use items to Japanese military users, for military purposes, and for any other end-user applications that could enhance Japan's military strength. From a positive perspective, these black swan events have accelerated the upgrading of tungsten's value as a key strategic metal, driving up demand for safe-haven assets. However, the tungsten market also faces the risk of adjustments in the international supply and demand structure, including escalating international trade frictions and possible sanctions restricting the cross-border flow of tungsten and related products, as well as the potential impact of the research and application of alternative materials due to international tungsten supply shortages. These intertwined factors may further amplify market volatility and test the resilience and adaptability of the tungsten industry chain.

Today, tungsten prices continued their strong performance. The tight supply situation at tungsten mines and smelters has not improved significantly, and holders of goods maintain a firm confidence in supporting the market. Downstream powder metallurgy companies mainly focus on rigid demand, and supported by raw material costs, their product prices have risen in line with market trends. Following a significant upward shift in tungsten scrap prices, market willingness to sell for cash has increased, but corresponding buying sentiment remains relatively cautious. As of press time:

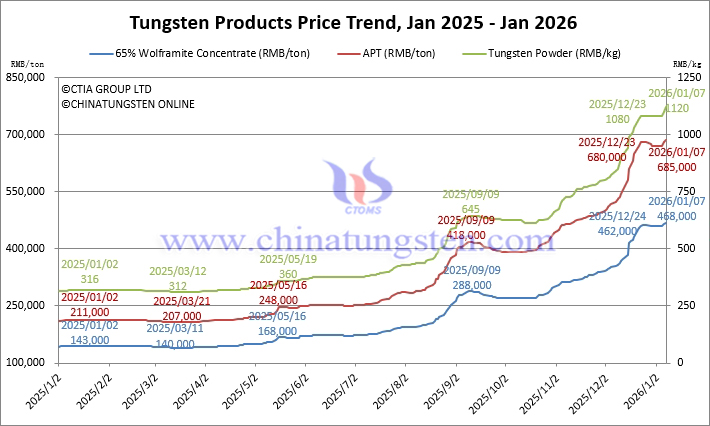

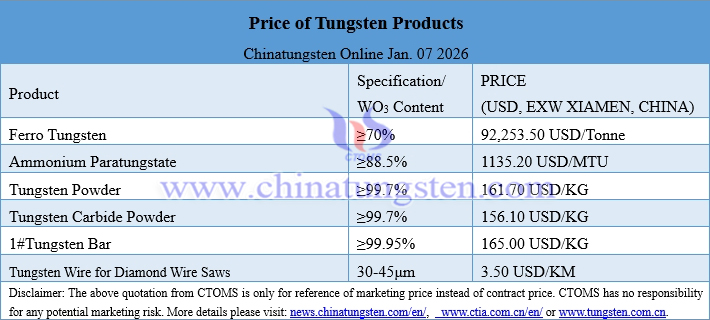

65% wolframite concentrate is priced at RMB 468,000/ton.

65% scheelite concentrate is priced at RMB 467,000/ton.

Ammonium paratungstate (APT) is priced at RMB 685,000/ton.

European APT is priced at USD 900-945/mtu (equivalent to RMB 557,000-585,000/ton).

Tungsten powder is priced at RMB 1,120/kg.

Tungsten carbide powder is priced at RMB 1,080/kg.

Cobalt powder is priced at RMB 560/kg.

70% ferrotungsten is priced at RMB 655,000/ton.

European ferrotungsten is priced at USD 133-142/kg W (equivalent to RMB 651,000-695,000/ton).

Scrap tungsten rods are priced at RMB 660/kg.

Scrap tungsten drill bits are priced at RMB 650/kg.

Prices of Tungsten Products on January. 7, 2026

Tungsten Price Trend from January 2025 to January 2026