Analysis of Latest Tungsten Market from Chinatungsten Online

This week, tungsten prices experienced a slight upward trend before entering a consolidation phase. With the last weekend of 2025 approaching, market sentiment is complex. On one hand, tungsten raw material prices remain stable at high levels, mainly due to tight supply and price support ahead of the annual financial settlement deadlines for various companies. On the other hand, the tungsten waste and scrap market is highly sensitive to market trends, and recently, profit-taking has led to a correction, deepening panic.

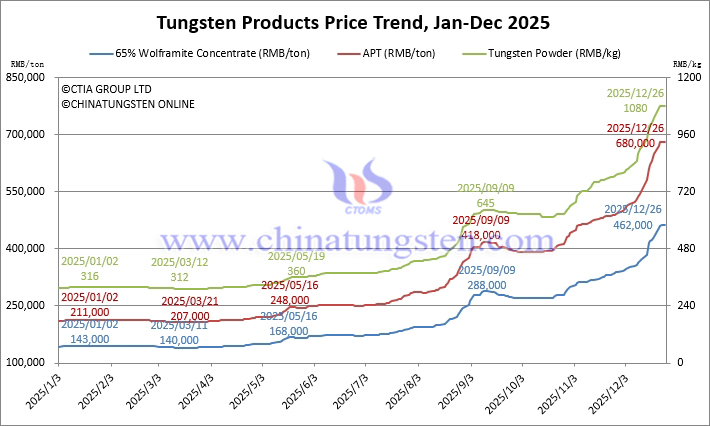

The current tungsten market situation is remarkably similar to that of mid-to-late September this year. At that time, after the September 3rd military parade, tungsten prices reached a historical high. Subsequently, the tungsten waste and scrap market, as it is now, was the first to experience concentrated profit-taking and selling, with prices falling by 13.5%, leading the entire industry chain down. Tungsten concentrate, APT, and tungsten powder fell by 6.3%, 6%, and 4.7%, respectively. Subsequently, driven by tight tungsten raw material supply and investor sentiment, tungsten prices rose all the way to their current high, facing a similar situation again. Whether the tungsten market will stabilize and continue to rise, or undergo a slight correction before rising again, or enter a period of decline and correction, depends on the market trend after the New Year's Day holiday.

As of press time,

65% wolframite concentrate is priced at RMB 462,000/ton, up 7.4% week-on-week and 223.1% year-to-date.

65% scheelite concentrate is priced at RMB 461,000/ton, up 7.5% week-on-week and 224.7% year-to-date.

Ammonium paratungstate (APT) is priced at RMB 680,000/ton, up 4.6% week-on-week and 222.3% year-to-date.

European APT is priced at USD 825-900/mtu (equivalent to RMB 512,000-558,000/ton), up 6.2% week-on-week and 161.4% year-to-date.

Tungsten powder is priced at RMB 1080/kg, up 4.9% week-on-week and 241.8% year-on-year.

Tungsten carbide powder is priced at RMB 1040/kg, up 5.1% week-on-week and 234.4% year-on-year.

Cobalt powder is priced at RMB 515/kg, unchanged week-on-week and up 202.9% year-on-year.

70% ferrotungsten is priced at RMB 655,000/ton, up 7.4% week-on-week and 204.7% year-on-year.

European ferrotungsten is priced at USD 133-142/kg W (equivalent to RMB 653,000-697,000/ton), up 19.6% week-on-week and 212.5% year-on-year.

Scrap tungsten rods are priced at RMB 630/kg, up 1.6% week-on-week, down 4.5% from its peak, and up 186.4% year-on-year.

Scrap tungsten drill bits are priced at RMB 605/kg, up 3.4% week-on-week, down 3.2% from its peak, and up 165.4% from the beginning of the year.

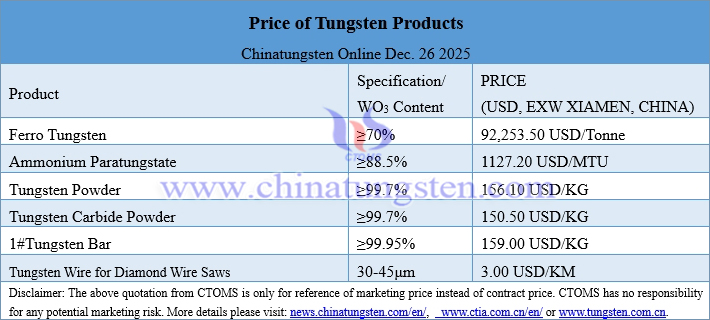

Prices of Tungsten Products on December 26, 2025

Tungsten Price Trend from January to December 26, 2025