Rare earth market update on December 26, 2025

This week, the domestic rare earth market overall showed a pattern of "prices exist but no market", with light and heavy rare earth product price trends diverging under the mutual influence of bullish and bearish factors. In the light rare earth market, mainstream product prices showed a pattern of initial decline followed by increase and then stabilization. At the beginning of the week, with general downstream demand and weak motivation among suppliers to raise prices, product prices continued the downward trend from last week; in the middle of the week, with enhanced production cost support, increased inquiries from magnetic material enterprises, and rising expectations of tightening future raw material supply, these factors jointly prompted suppliers' confidence in raising prices; towards the weekend, due to slow downstream demand follow-up pace and gradual consumption of bullish factors, the speed of product price increases slowed down. In the medium and heavy rare earth market, dysprosium-terbium prices showed a pattern of initial decline followed by stabilization. At the beginning of the week, affected by low market inquiry activity and greater funding pressure on rare earth manufacturers, suppliers generally had strong willingness to reduce prices for cash realization; towards the weekend, affected by the significant rise in praseodymium-neodymium prices, dysprosium-terbium prices stopped falling and stabilized.

According to CTIA GROUP LTD, this week praseodymium-neodymium oxide prices increased by approximately RMB 19,000/ton, up 3.30%; praseodymium-neodymium metal prices increased by approximately RMB 25,000/ton, up 3.57%; terbium oxide prices decreased by approximately RMB 70,000/ton, down 1.14%; dysprosium oxide prices decreased by approximately RMB 10,000/ton, down 0.74%; 55N neodymium-iron-boron blank prices increased by approximately RMB 1/kg, up 0.37%; neodymium-iron-boron scrap (praseodymium-neodymium) prices increased by approximately RMB 15/kg, up 2.52%.

On the news front, on December 25, 2025, the Ministry of Commerce held a regular press conference. A reporter asked: According to some U.S. market participants, China is still restricting some rare earth elements, such as some rare earth magnets, while the U.S. needs these elements for permanent magnet production. Will the Ministry of Commerce relax restrictions on rare earth magnet exports to the U.S.?

Ministry of Commerce spokesperson He Yongqian stated that the vast majority of rare earth magnets are general import and export goods, and fluctuations in trade data are normal market phenomena. China has always been committed to maintaining the security and stability of global industrial and supply chains, actively promoting and facilitating compliant trade.

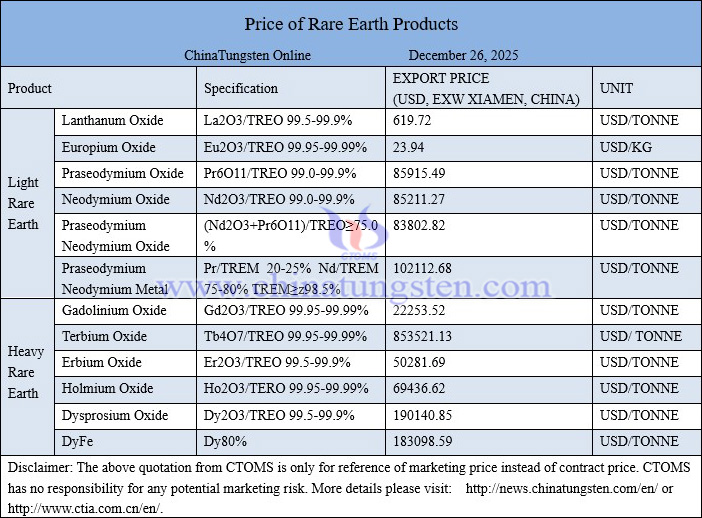

Price of rare earth products on December 26, 2025

Images of neodymium oxide