Analysis of Latest Tungsten Market from Chinatungsten Online

On Monday, the frenzied tungsten market continued, driven primarily by two factors: significant price increases in new long-term contracts from major tungsten producers, and the escalating news of production cuts and shutdowns at key tungsten raw material manufacturers, ranging from tungsten ore and tungsten compounds to tungsten powder and tungsten carbide powder. The tight supply situation intensified, fueling bullish sentiment and pushing overall tungsten product prices higher.

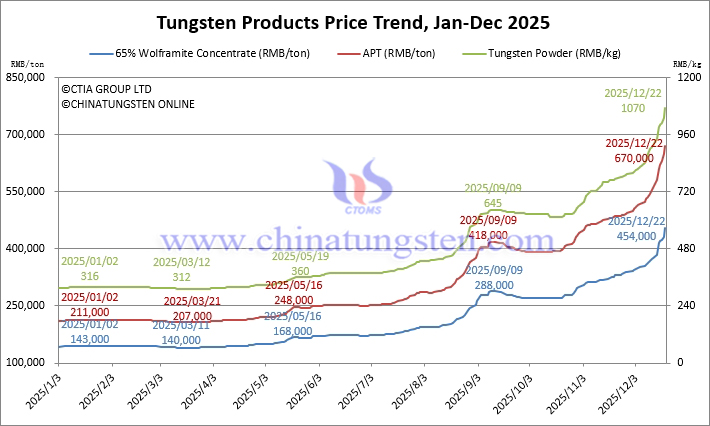

65% wolframite concentrate was priced at RMB 454,000/ton, up 217.5% from the beginning of the year.

65% scheelite concentrate was priced at RMB 453,000/ton, up 219.0% from the beginning of the year.

Ammonium paratungstate (APT) was priced at RMB 670,000/ton, up 217.5% from the beginning of the year.

European APT was priced at USD 825-900/mtu (equivalent to RMB 514,000-561,000/ton), up 161.4% from the beginning of the year.

Tungsten powder was priced at RMB 1,070/kg, up 238.6% from the beginning of the year.

Tungsten carbide powder was priced at RMB 1030/kg, up 231.2% from the beginning of the year.

Cobalt powder was priced at RMB 515/kg, up 202.9% from the beginning of the year.

70% ferrotungsten was priced at RMB 630,000/ton, up 193.0% from the beginning of the year.

European ferrotungsten was priced at USD 119-127/kg W (equivalent to RMB 586,000-626,000/ton), up 179.6% from the beginning of the year.

Scrap tungsten rods were priced at RMB 650/kg, up 195.5% from the beginning of the year.

Scrap tungsten drill bits were priced at RMB 615/kg, up 169.7% from the beginning of the year.

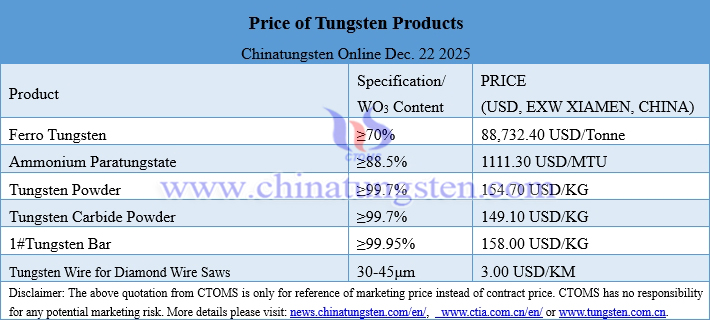

Prices of Tungsten Products on December 22, 2025

Tungsten Price Trend from January to December 22, 2025